Free Promissory Note Template – Adobe PDF & Microsoft Word

A promissory note is an agreement to borrow money from someone else stating specific time-periods for being paid-back along with an interest rate, late payment penalties, and any other terms the parties agree upon.

Release Form – After a note has been paid in full, the lender will usually issue a release (or can be requested by the borrower). This is a receipt that states the repayment of the note has been satisfied and there is no financial obligation by either party.

Types

There are two (2) main types of promissory notes:

Secured – Type of loan agreement that secures an asset for the lender in the event that the borrower does not pay that the said asset will be transferred to the lender.

Unsecured – Type of loan contract that does not have an asset that is secured in the chance that the borrower does not pay back the amount loaned. In the case of non-payment, the lender would have an unpaid note and would have to go through alternative or legal measures to be paid back.

Forms By State

How to Write

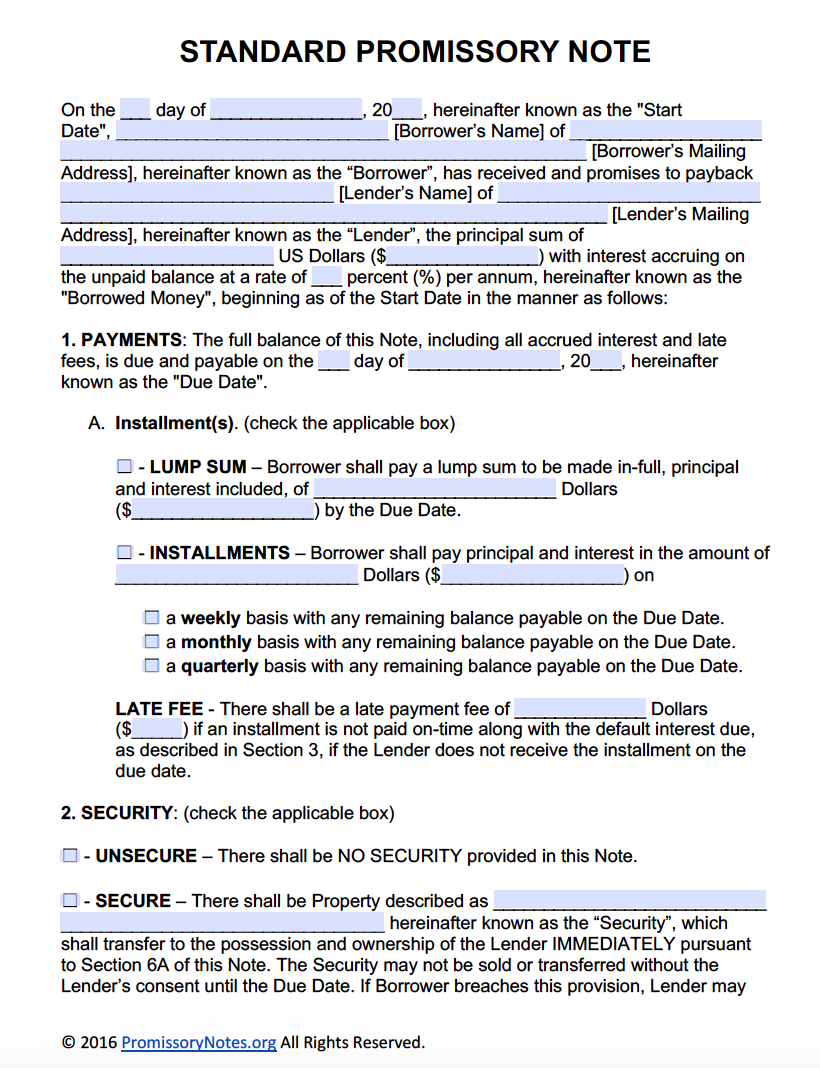

Step 1 – Download the Selected Document – Enter the following information:

- Date the execution of the document in dd/m/yy format

- Name of the borrower

- Borrower’s mailing address

- AND

- Lender’s name

- Lender’s mailing address

- AND

- Submit the principal sum of the note in the dollar amount

- The percentage of the accruing interest annually

Step 2 – Payments –

- Submit the the date in dd/m/yy format in which the entire balance, to include all accrued late fees and interest would be due

- Check the box that shall apply to the agreement between the parties

- Lump Sum – Enter the amount that shall be paid in full including principal and interest

- Enter the due date for a lump sum payment

- OR

- Installments – Enter the amount of Principal and Interest to be paid

- Select the frequency of the payments to be made

- Enter the amount of a required late fee in the event any payments are late

Step 3 – Security – Select and check the applicable box

- Unsecure – Simply check the box if this is the selection

- Secure – If the note shall be secured, check the box and enter a description of the property that shall be used as security against the note

- Review the remainder of the paragraph

Step 4 – Titled Sections and Subsections – The parties must review and understand the following:

- Interest Due in the Event of Default

- Allocation of Payments

- Prepayment

- Acceleration (6A – Security)

- Attorney’s Fees and Costs

- Waiver of Presentments

- Non-Waiver

- Severability

- Integration

- Conflicting Terms

- Notice

- Co-Signer – Select the applicable box) – In the event there will be a co-signer, enter the person’s name

- Exectution

- Governing Law – Enter the state in which the document has been executed

Step 5 – Signatures – Submit all required signatures. The witness must be present for all signatures.

- Lender’s Signture

- Date of signature in mm/dd/yyyy format

- Lender’s printed name

- AND

- Borrower’s Signature

- Date of signature mm/dd/yyyy

- Borrower’s printed name

- AND

- Co-Signer’s Signature (if any)

- Date of signature (mm/dd/yyyy)

- AND

- Witness’ Signature

- Date of signature mm/dd/yyyy format

- Witness’ printed name

Generic Promissory Note – Adobe PDF – Microsoft Word